How Much Mortgage Can I Afford On My Salary Calculator Usa

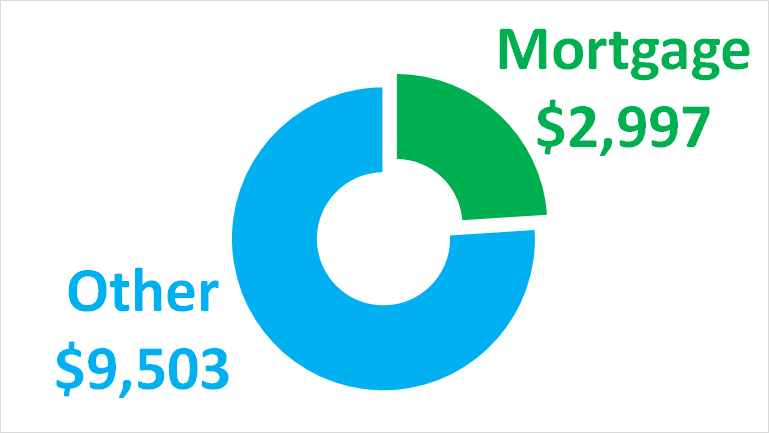

For example lets say your pre-tax monthly income is 5000. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

How Much House Can I Afford Bhhs Fox Roach

This will give you the monthly payment that you can afford.

How much mortgage can i afford on my salary calculator usa. Quickly find the maximum home price within your price range. If you are going for a bigger project that your salary or the 40 of gross cant take care of. The 2836 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Your total debt payments including housing costs cant. Table of the breakdown of the maximum home price that you can afford by loan amount and down payment. This mortgage calculator will show how much you can afford.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Once you input your monthly obligations and income the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment and total mortgage amount that you can afford based on your current financial situation. -- The sum of the monthly mortgage monthly tax and other monthly debt payments must be less than 43 of your gross pre-taxes monthly salary.

Your housing expenses should be 29 or less. Many lenders place more emphasis on the back-end ratio than the front-end ratio. For example a house appraised at 250000 in Houston or one of its suburbs has an.

As a rule of thumb mortgage lenders dont want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking. Your mortgage payment should be 28 or less. To calculate how much 28 percent of.

Your eligibility is decided by the bank basis your salary. Your debt-to-income ratio DTI should be 36 or less. Most lenders require borrowers to keep housing costs to 28 or less of their pretax income.

Estimate how much home you can afford with our affordability calculator. You can find this by multiplying your income by 28 then dividing that by 100. Factors that impact affordability.

Ideally you should not have total debt beyond 40 of your gross income. While your personal savings goals or spending habits can impact your affordability getting pre. While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes.

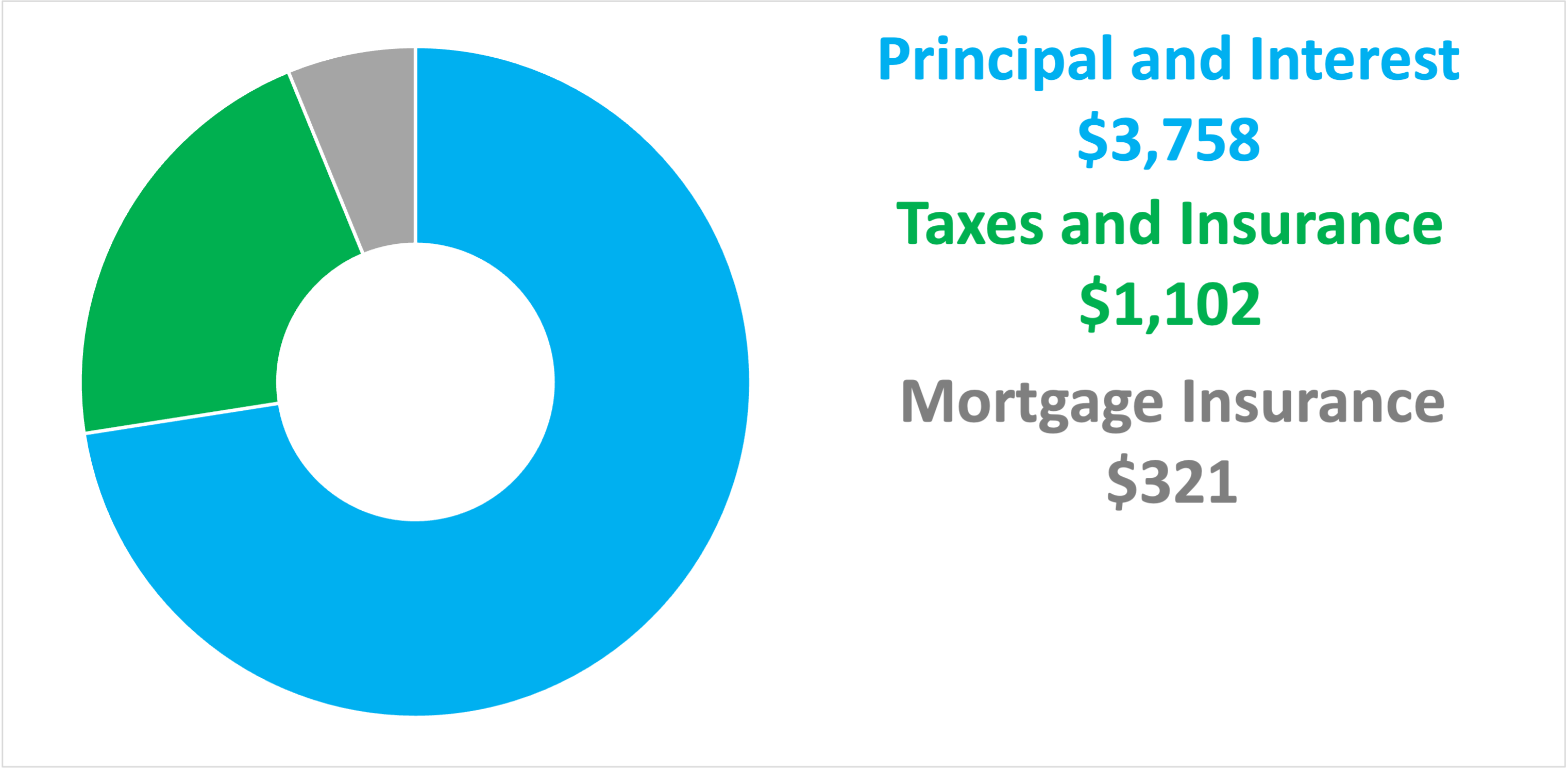

Private mortgage insurance PMI 1247 67 percent. Thats the general rule though they may go to 41 percent. Property tax rates in Texas are levied as a percentage of a homes appraised value.

The percentage depends on local tax rates from schools and other county concerns so it varies per area. The calculator shows two sets of results. A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. -- The sum of the monthly mortgage and monthly tax payments must be less than 31 of your gross pre-taxes monthly salary. Simply enter your monthly income expenses and expected interest rate to get your estimate.

Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well. To determine how much you can afford for your monthly mortgage payment just multiply your annual salary by 028 and divide the total by 12. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Your salary must meet the following two conditions on FHA loans.

When it comes to calculating affordability your income debts and down payment are primary factors.

![]()

How Much House Can I Afford Interest Com

How Much House Can I Afford The Simple Dollar

Home Affordability Calculator For Excel

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Can I Afford To Buy A Home Mortgage Affordability Calculator

Is 50k Per Year Good Money Living On 50 000 Salary

Downloadable Free Mortgage Calculator Tool

How Much A 250 000 Mortgage Will Cost You Credible

Va Mortgage Calculator By Zillow

![]()

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

![]()

Mortgage Qualifier Calculator How Much Can You Afford

I Make 150 000 A Year How Much House Can I Afford Bundle

How Much House Can I Afford Forbes Advisor

700k Mortgage Mortgage On 700k Bundle

How Much House Can I Afford Bhhs Fox Roach

Nevada Mortgage Calculator Smartasset

Post a Comment for "How Much Mortgage Can I Afford On My Salary Calculator Usa"